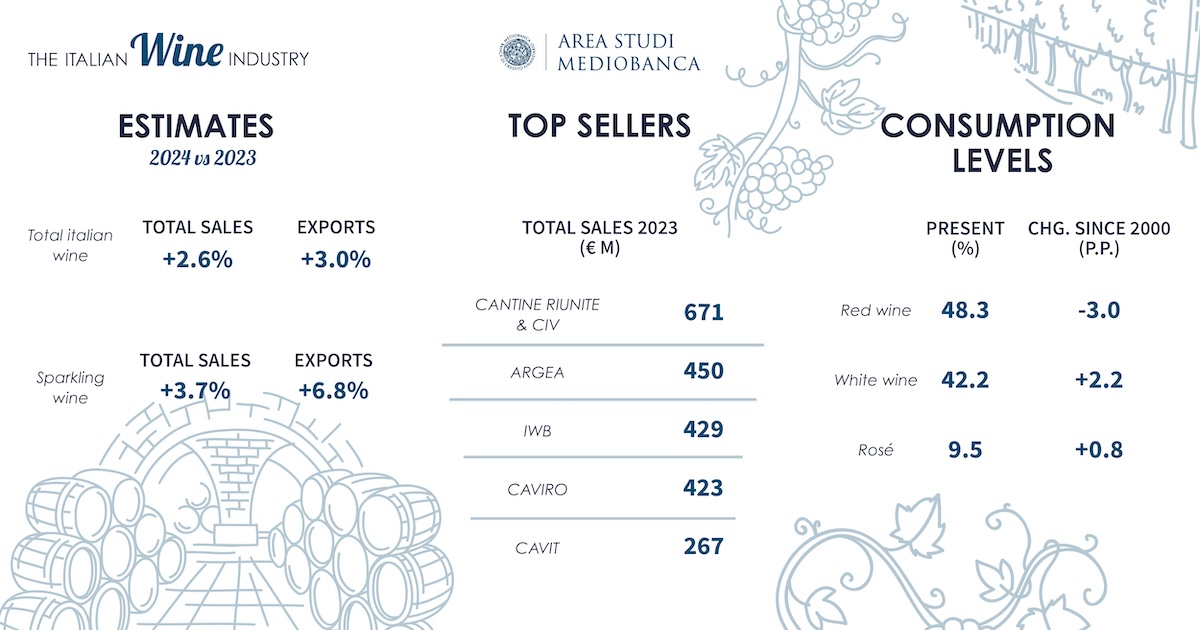

Global wine production in 2023 has been estimated at 237 million hectolitres, a strong decrease on 2022 (down 9.6%). Global consumption has been estimated at 221 million hectolitres (down 2.6%). Changes in demand, produced by generational turnover, healthier lifestyles and climatechange, have driven a reduction in the consumption of red wine, which has declined from anaverage share of 51.3% in the 2000-04 period, to 48.3% in the 2017-21 period.

By contrast, the consumption of white wines has reflected the opposite trend, rising from 40% to 42.2%, an increase of 2.2 percentage points, as has the consumption of rosé wines (up from 8.7% to 9.5%, an increase of 0.8 percentage points). Italy has followed the trends seen at world level, reporting a 23.2% decrease in production compared to 2022, and a 1.6% decrease in consumption, with 37.4 litres of wine consumed per annum). The balance of payments reflects a surplus in Italy: in 20 years the surplus has grown at an annual average rate of 5.5%, rising from €2.5bn in 2003 to 7.2% in 2023. Italy is the world’s leading exporter of wine in terms of quantity (21.4 million hectolitres in 2023) and ranks second in terms of value (€7.7bn, behind only France with €11.9bn).

2023 and beyond for the Italian wine-making industry

The leading Italian wine makers see growth of 2.6% in total sales for 2024, and of 3% for exports. Optimism continues in the area of sparkling wine, where total revenues are expected to increase by 3.7%, exports especially (up 6.8%), whereas sales of non-sparkling wines are expected to increase by 2.3% (exports up 2.2%).

In 2023, the leading Italian wine markets reported very little change compared to the previous year (total sales down 0.2% vs 2022), with the domestic market (total sales down 0.7%) slightly underperforming the international market (total sales up 0.3%). Exports of sparkling wines in particular posted an impressive performance, up 2.5%. The Ebit margin reported a 1.4% increase vs 2022, while net profit accounted for 4.2% of total sales.

Quantities of wine sold were down 4.5% in 2023 across all channels. Inflation eroded households’ purchasing power, penalizing sales of wine in the intermediate bracket (which decreased by 10.1% relative to 2022), confirming the increased polarization of the market. Low quality wines also reported a slight decrease in sales (down 1.7%), with a market share of 44.2%. The wine market is increasingly premium in nature (sales of very fine wines were up 12.7% on 2022, for a market share of 18.6%) and is also more sustainable (sales of organic wines were up 1.4%, for a market share of 5.4%; vegan wines up 9.6%, for a market share of 2.7%, and natural wines up 1.8%, for a market share of 1%).

Italian companies the top performers

The Cantine Riunite-GIV group continues to lead the way in terms of total sales in 2023, with total revenues of €670.6m (down 3.4% on 2022). Second place was again taken by the Argea wine group (€449.5m, down 1.2%), followed by IWB with €429.1m (down 0.3% on 2022).

Romagna-based co-operative Caviro also posted 2023 revenues of over €400m (€423.1m), up 1.4% on 2022. A total of seven companies recorded total sales of between €200 and €300m: the Trentino-based co-operative Cavit (2023 total sales €267.1m, up 0.9% on 2022), Santa Margherita from the Veneto region (€255.4m, down 2%), Antinori from Tuscany (€250.3m, up 1.9%), La Marca, which specializes in the production of spumanti, and delivered 2023 total sales of €225.8m (down 4%), Piedmont-based Fratelli Martini (€219.6m, up 1.1%), Mezzacorona from Trentino (€217.7m, up 2%), and the Collis group which, having expanded its area of

consolidation, posted total sales of €209.4m (up 64.8% on 2022). In terms of profitability (i.e. net profit as a percentage of total sales), Tuscan wine-maker Frescobaldi led the rankings in 2023 with 29%, followed by Veneto-based Santa Margherita (18.5%). In third place came Antinori, with net profit equal to 17% of total sales, 2.6 percentage points higher than in 2022. Some companies reflect very high percentages of exports, which in some cases even account for almost all their groups’ total sales: such as the Fantini Group with 96.4%, Ruffino with 91.1%, and Argea with 89.9%.

DOC and DOCG wines: regional excellences

In 2023 some 47.7% of Italian wine qualified as having DOP (protected designation of origin) status (DOC and DOCG), compared with just 38.5% in 2013. IGP wines (protected geographical indication) wines decreased from 35% in 2023 to 27% in 2023, approaching the percentage accounted for by table wine (25.3% in 2023). In regional terms Piedmont accounted for the lion's share, with 19 DOCG and 41 DOC wines, followed by Tuscany (11 DOCG, 41 DOC and 6 IGT) and Veneto (14 DOCG, 29 DOC and 10 IGT). Some 39.3% of the production of DOP wines is concentrated in Tuscany; while in Piedmont 94.6% of the regional production is DOP in nature.

Overall the value of the bottled DOP and IGT wines is equal to €4.3bn in Veneto, followed by Piedmont with €1.4bn and Tuscany with €1.2bn. These regional excellences are driving companies’ performances: the Tuscan wine-makers reported the highest Ebit margin (16.5%) and the highest ROI (6.3%), with Veneto and Piedmont equal in second position (both with 6.1%). Tuscany also reflects the highest financial solidity, with net debt accounting for just 18.4% of the capital invested. The largest exporters are the Piedmontese wine companies, where exports account for 64.5% of their turnover, followed by the Tuscan firms (60.6%). In 2023 exports drove the growth posted by the firms based in the Friuli region (whose total sales were up 6.1% and exports up 22.3%), and also of the firms based in Lombardy (total sales up 4.4%; exports up 7.4%) and in Emilia-Romagna (up 1.6% and up 8.6% respectively). Optimism for 2024, where growth is expected in Emilia-Romagna (up 4.6%), Puglia (up 4.3%), and Piedmont (up 4.2%).

Family-owned companies in difficulty over sustainability issues

Family-controlled companies account for 64.8% of the aggregate net equity, a share which rises to 81.4% if the co-operatives are also considered. Financial investors own 10.9% of the shareholders’ equity: banks and insurance companies (5.2%) are not represented among the owners of the smaller companies, whereas private equity funds (which own 4.1% of the net equity) invest in the share capital of the leading wine-makers regardless of their size. NonItalian ownership also decreases with size, and accounts for 7.6% of net equity. Relations with financial markets are negligible: only two wine companies have been listed on the AIM since

2015 (Masi Agricola and IWB).

Work to be done in the area of sustainability Only 34.9% of the leading Italian wine makers prepare sustainability reporting (38.6% of the producers with turnover of more than €50m). The main reasons for this are: the complexity of the validation and finalization process (for 26.8% of the companies), the lack of benchmarks or reference best practice (14.3%), the difficulties of involving the relevant company units and the lack of specific competences (10.7%).

The full survey is available for download from Area Studi Mediobanca.